How to Read Your Invoice

To help you navigate your CHEP invoice this site highlights

and explains the elements you need to know.

Click the relevant link to view details

The account associated with this invoice

Invoice contact identified on our records

The date the invoice was generated. You can check your invoice frequency by looking at the 13 period spend analysis graph and noting the previous period. The invoicing periods may be weekly, fortnightly or monthly.

The date the invoice is due for payment and will generally be 7 days from the invoice date.

This shows your Purchase Order Number and your Customer Reference Number if one is provided to us.

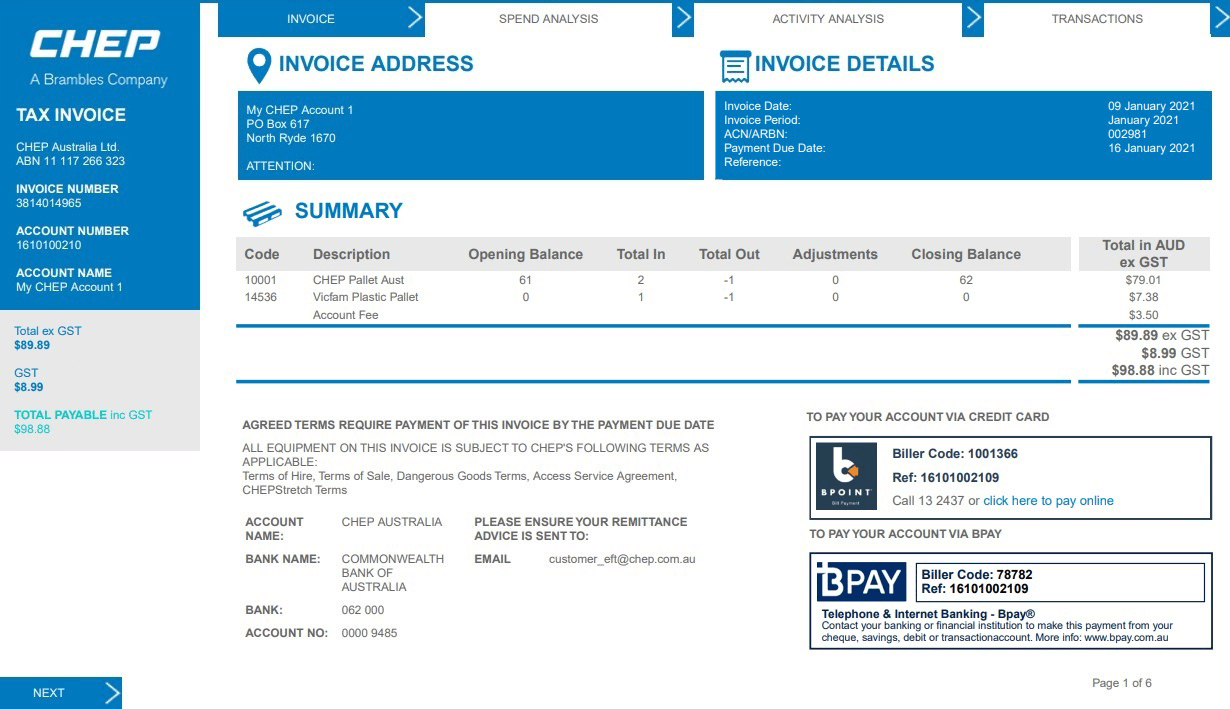

A summary of physical equipment balances and movements for the invoice period by equipment type. It also shows a total charge grouped by equipment code.

The closing equipment balance from the previous invoice.

The sum of Issues, Transfers On, Reversals to Transfers Off and Corrections to Transfers On, excluding Adjustments.

The sum of Returns, Transfers Off, Reversals to Transfers On and Corrections to Transfers Off, excluding Adjustments.

The sum of Adjustments including Admin Movements, Excess On/Off Movements, Equipment Compensations and Deposit Refund Equipment Clearing.

The sum of Opening Balance, Total In, Total Out and Adjustments to provide a Closing Balance.

This shows total $ due excluding GST

This shows the different payment options available for your CHEP account. When paying by EFT please use your CHEP Account Number or Invoice Number as a reference.

To save you time, your BPAY details are here for faster payment options using your unique reference number.

To save you time, your BPoint details are here for faster payment options using your unique reference number.

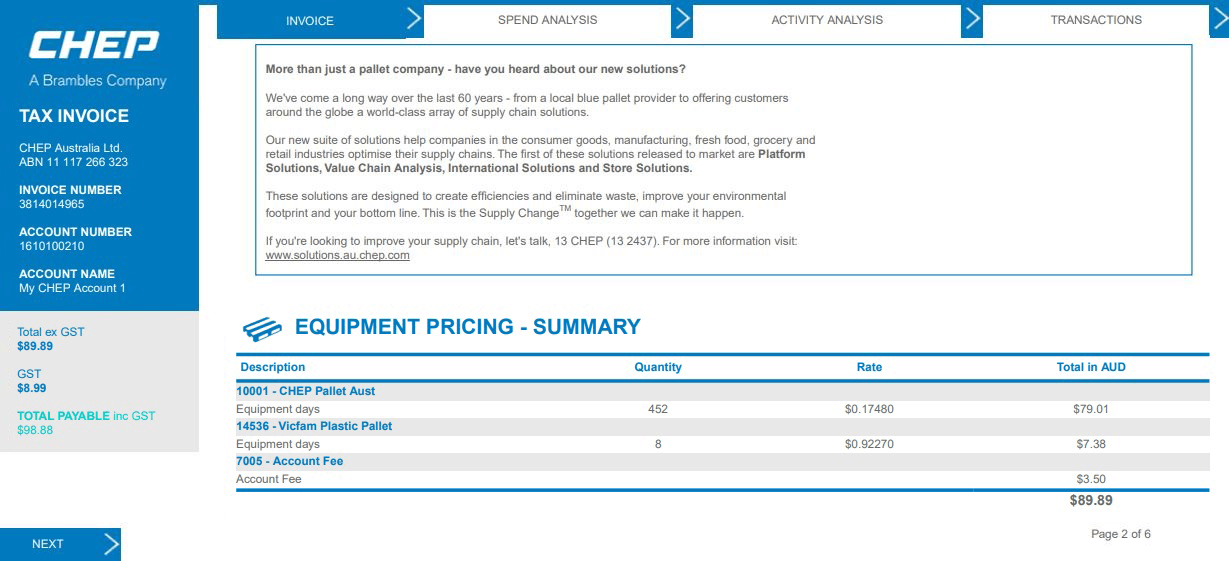

A summary of charges by equipment code and charge type. Charge types include Daily Hire Rate, Issue Fees, Transport Fees, Relocation fees.

This displays your $ rate for each charge type sorted by equipment code.

Charge types include Daily Hire Rate, Issue Fees, Transport Fees, Relocation Fees.

For example:

Equipment days: Your daily hire rate.

Issues: Your issue fee.

The total amount owing sorted by equipment code and charge type. Charge types include Daily Hire Rate, Issue Fees, Transport Fees, Relocation Fees.

For example:

Equipment days: Quantity x Rate = Total in AUD.

Issues: Rate x Total Issues = Total in AUD. (While this table doesn't show the total issues, this can be taken from the transaction page).

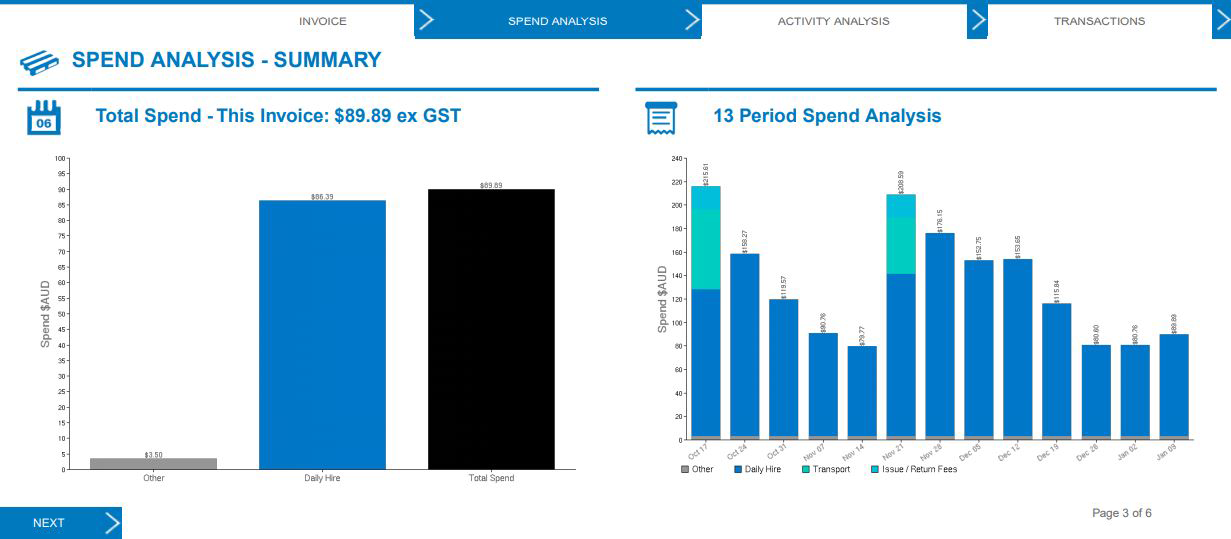

Shows the breakdown of your spend by charge type. Charge types include Daily Hire Rate, Issue Fees, Transport Fees, Relocation Fees

A comparison graph based on your last 13 invoices (time period will depend on your invoice frequency) showing spending patterns for each charge type. Charge types include Daily Hire Rate, Issue Fees, Transport Fees, Relocation Fees.

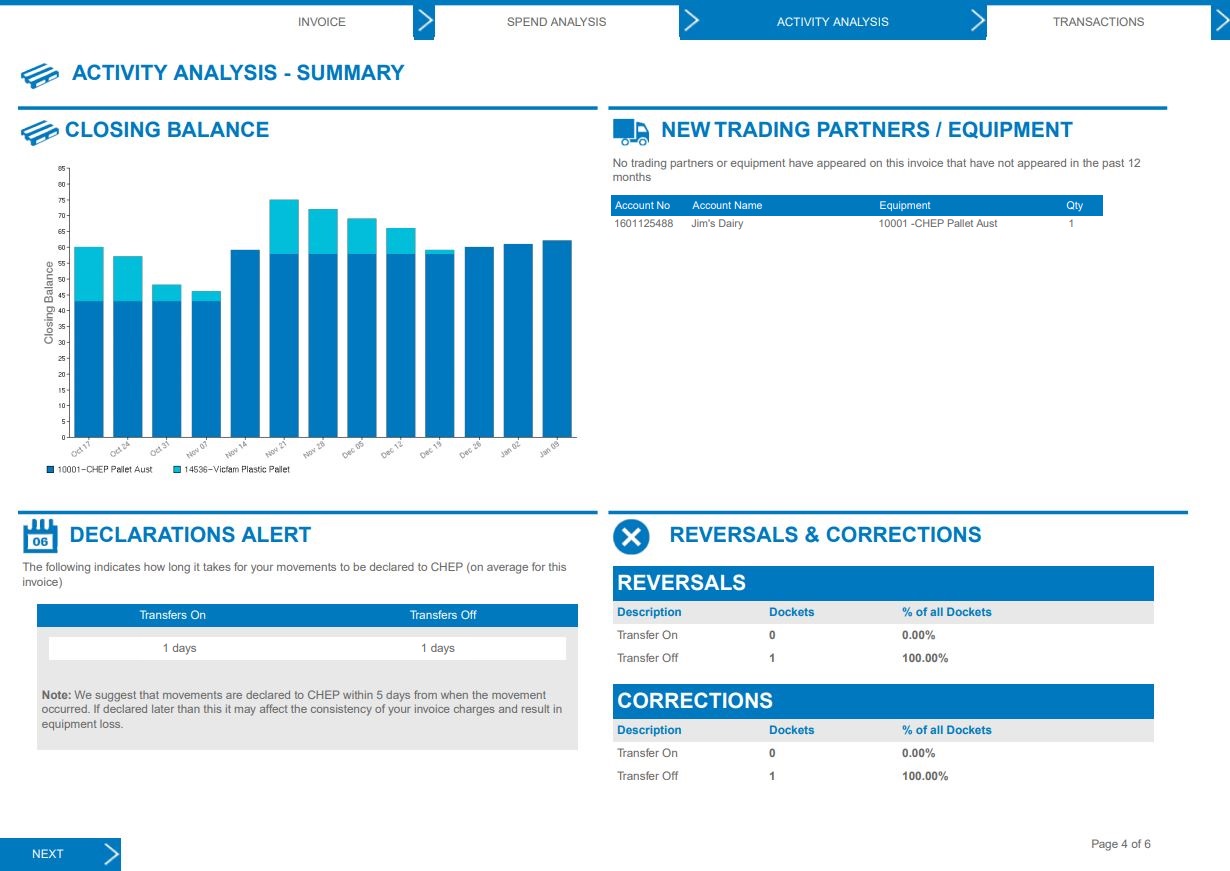

Current invoice closing balance (stacked by equipment type) for the current invoice period, as well as the previous 12 invoice periods.

Contains any new trading partners or equipment types in this invoice. New is defined as any equipment type or trading partner that hasn't had any activity in the past 12 months.

How long it takes for your Transfer On's to be advised to CHEP (on average for this invoice).

This is calculated by subtracting the movement date from the date of notification against each Transfer On for this invoice and calculating the average.

How long it takes for your Transfer Off's to be advised to CHEP (on average for this invoice).

This is calculated by subtracting the movement date from the date of notification against each Transfer Off for this invoice and calculating the average.

The number of Transfer On and Transfer Off movements which have been reversed on this invoice. Please note, reversal totals also include reversals that form part of correction transactions.

A calculation of the % of all dockets of the same type which have been reversed during this invoice period.

For example, if there we a total of 100 Transfer On movements and 1 Transfer On movement was reversed, this value would show 1% in the Transfer On row.

The number of Transfers On and Transfer Off movements which have been corrected (following a reversal) on this invoice.

A calculation of the % of all dockets of the same type which have been corrected (after a reversal) during this invoice period.

For example, if there we a total of 100 Transfer Off movements and 2 Transfer Off movements were corrected, this value would show 2% in the Transfer Off row.

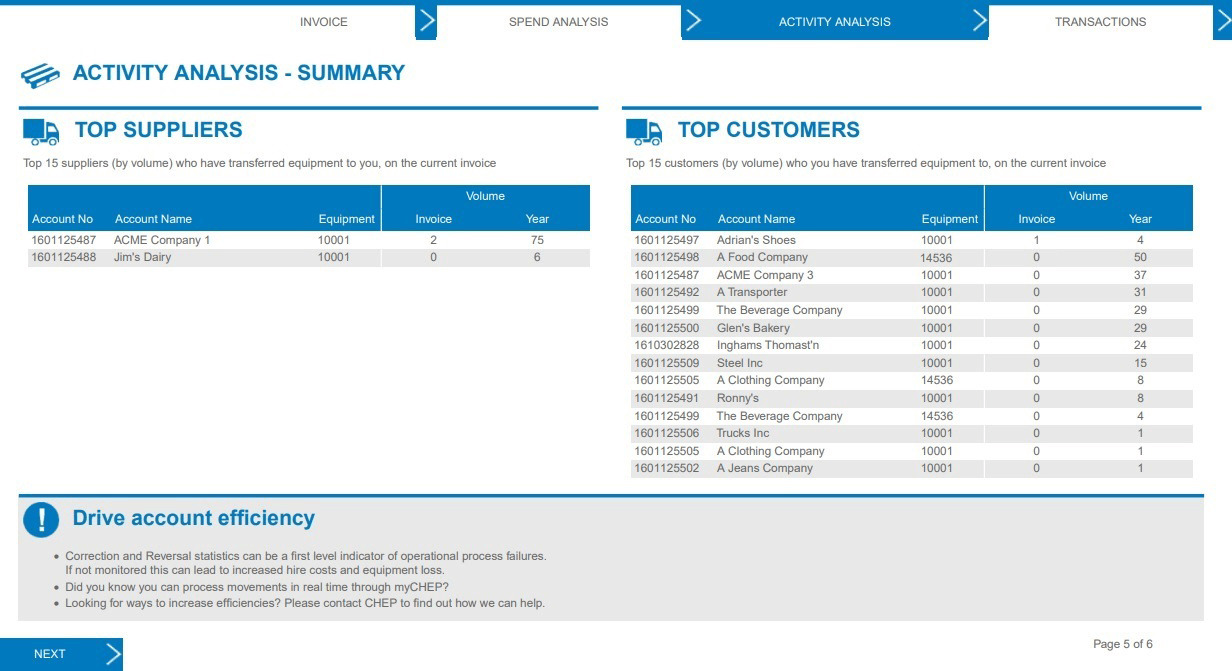

An overview of your top 15 suppliers for this invoice period. It details the equipment transferred on to your account on this invoice, as well as a count of equipment transferred on within the last 12 months for your reference.

An overview of your top 15 customers for this invoice period. It details the equipment transferred off your account on this invoice, as well as a count of equipment transferred off within the last 12 months for your reference.

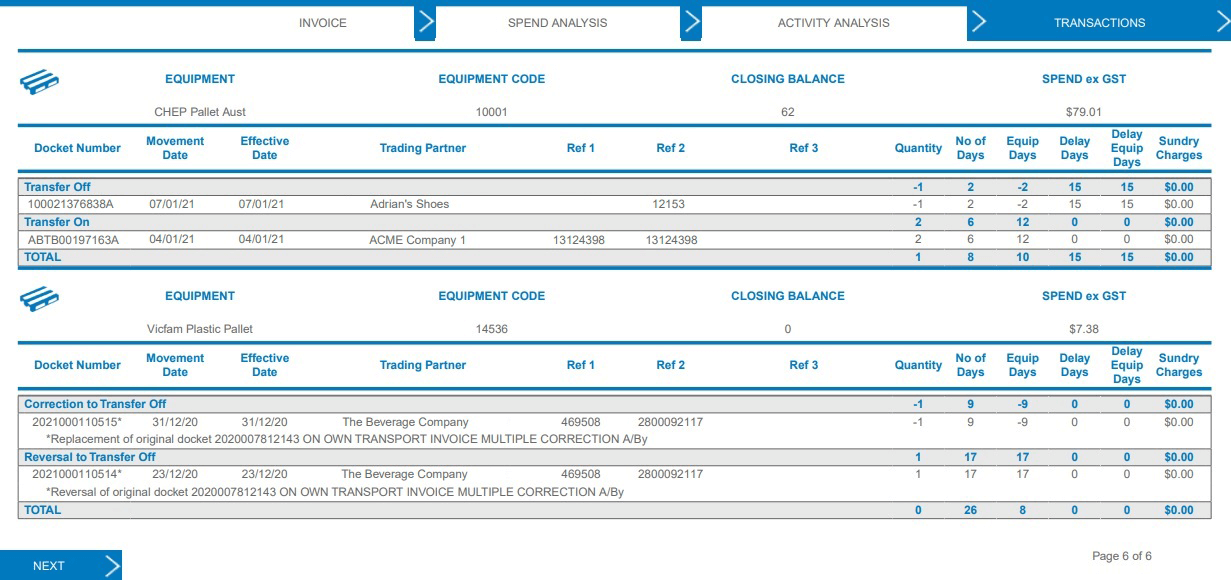

All transactions that make up this invoice are listed in this section and grouped by equipment type (Displays both equipment name and code).

Quantity of equipment on your account at the close of this invoice. The closing balance total is calculated by taking the opening balance of units, adding Issues and Transfers On, deducting Returns and Transfers Off and adding or deducting Adjustments and Compensations.

The total cost attributed to the equipment type on this invoice.

Each column will be calculated with a subtotal based on the transaction type.

The date the equipment physically moved. Also known as the shipment date in myCHEP.

The date that the transfer becomes effective. It reflects the financial liability of the transaction.

The sending or receiving party on the other end of the transaction.

For Issues and Returns this is the registration of the vehicle that transports the equipment.

For trading partner movements this is the secondary reference or Other Ref in myCHEP.

For Issues and Returns this is the transporter.

For trading partner movements this is the primary reference or Ref in myCHEP.

For Issues and Returns this is the primary reference.

For trading partner movements this is blank.

The physical equipment quantity on the transaction.

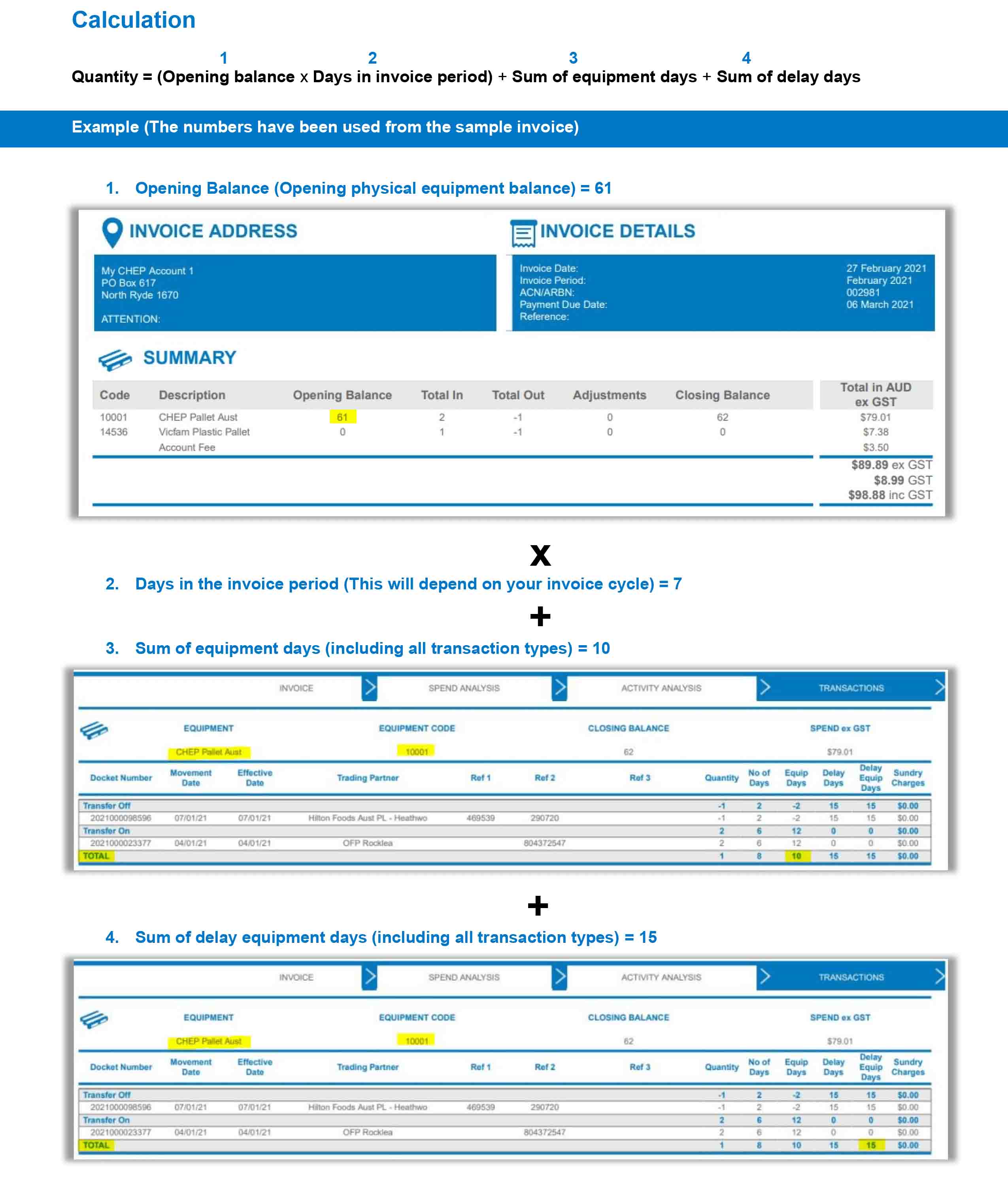

The number of days between the invoice date and the movement date.

The quantity column multiplied by the number of days column.

The number of days between the effective date and movement date. Where a delay day agreement is in place, this will be applied automatically and the effective date will not reflect the amended date.

The quantity multiplied by the delay days.

Financial Adjustment raised not related to a specific Equipment Movement

It is important to understand the flow of movements when they are corrected:

1. Original Movement

2. Reversal Movement (the transaction may end here, or can continue on to be fully corrected)

3. Correction Movement

- Reversal text highlights that a previous movement has been reversed and will note the docket number of that original movement. No details change in a reversal, the only difference is the direction of the movement.

- Replacement is subsequent modification of original Transaction. This will usually have some detail modified (date, qty, equipment, etc.).

The items in this section will be subsequent costs associated with transactions on the invoice (e.g. Transport Costs of Issues or Returns, Issue Fees, etc.).

This section will contain a transaction which will adjust the negative equipment days on the invoice to bring the total back to 0, or offset positive products days if an historic credit exists.

This section will contain a transaction which will adjust the negative balance on the invoice to bring the total back to 0, or offset a positive balance if an historic credit exists.